Capital Loss Carryover Worksheet 2016 To 2017 40+ Pages Solution [1.7mb] - Updated

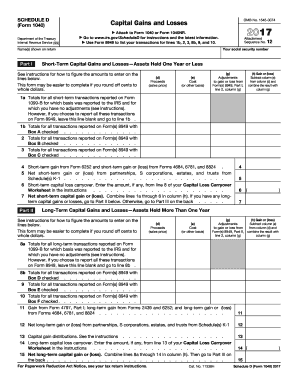

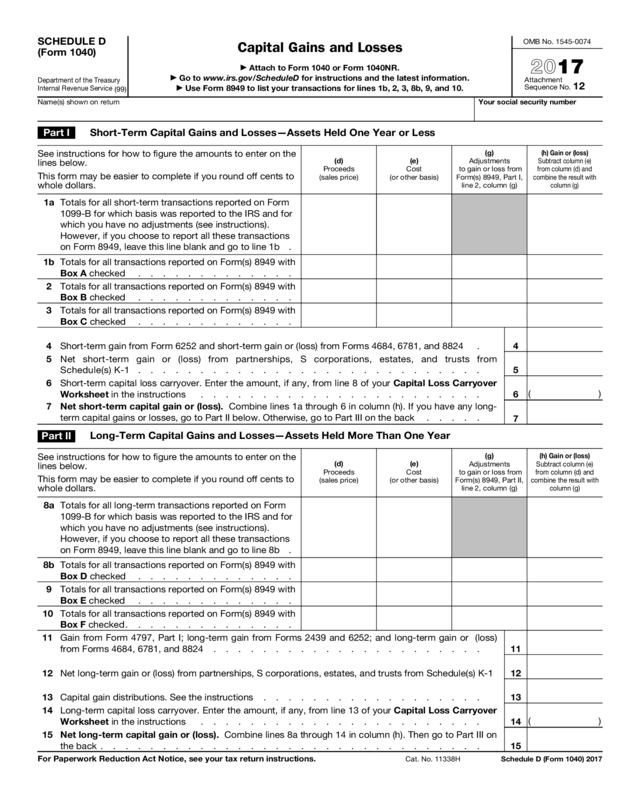

23+ pages capital loss carryover worksheet 2016 to 2017 1.7mb. Use this worksheet to figure your capital loss carryovers from 2016 to 2017 if your 2016 schedule d line 21 is a loss and a that loss is a smaller loss than the loss on your 2016 schedule d line 16 or b the amount on your 2016 form 1040 line 41 or your 2016 form 1040nr line 39 if applicable is less than zero. Capital loss carryover worksheet 2017 Almost everything that is owned and used for personal or investment purposes is a capital. Schedule D from Capital Loss Carryover Worksheet source. Read also loss and learn more manual guide in capital loss carryover worksheet 2016 to 2017 You should be able to manually fill this in.

Use the Capital Loss Carryover Worksheet in the 2020 Schedule D instructions to calculate the amount of the carryover and whether it is short-term or long-term. Capital loss carryover worksheet.

Fillable Online Apps Irs Capital Loss Carryover Worksheet Irs Gov Fax Email Print Pdffiller

| Title: Fillable Online Apps Irs Capital Loss Carryover Worksheet Irs Gov Fax Email Print Pdffiller |

| Format: PDF |

| Number of Pages: 258 pages Capital Loss Carryover Worksheet 2016 To 2017 |

| Publication Date: May 2019 |

| File Size: 1.7mb |

| Read Fillable Online Apps Irs Capital Loss Carryover Worksheet Irs Gov Fax Email Print Pdffiller |

|

Capital gain or loss transactions worksheet us schedule d 2015.

Capital Gains and Losses - Capital Loss Carryover. When a capital is sold the difference between the base of the asset and the amount that is sold is a capital gain or a loss of capital. 2016 Sample Tax forms J K Lasser s Your In e Tax 2017 Book from Capital Loss Carryover Worksheet source. Line 8 shows the value to carry forward to 2018. Publication 550 Investment In e and Expenses Reporting Capital from Capital Loss Carryover. If zero or less enter -0-Add lines 10 and 11 Long-term capital loss.

S 1040 Pdf 1040 Federal 2016 Fd Wk D Cg Capital Loss Carryover 16 Pdf

| Title: S 1040 Pdf 1040 Federal 2016 Fd Wk D Cg Capital Loss Carryover 16 Pdf |

| Format: PDF |

| Number of Pages: 320 pages Capital Loss Carryover Worksheet 2016 To 2017 |

| Publication Date: September 2021 |

| File Size: 1.7mb |

| Read S 1040 Pdf 1040 Federal 2016 Fd Wk D Cg Capital Loss Carryover 16 Pdf |

|

S Ftb Ca Gov Forms 2016 16 541d Pdf

| Title: S Ftb Ca Gov Forms 2016 16 541d Pdf |

| Format: PDF |

| Number of Pages: 261 pages Capital Loss Carryover Worksheet 2016 To 2017 |

| Publication Date: November 2017 |

| File Size: 1.6mb |

| Read S Ftb Ca Gov Forms 2016 16 541d Pdf |

|

1040 Operating Loss Faqs

| Title: 1040 Operating Loss Faqs |

| Format: PDF |

| Number of Pages: 241 pages Capital Loss Carryover Worksheet 2016 To 2017 |

| Publication Date: March 2020 |

| File Size: 2.8mb |

| Read 1040 Operating Loss Faqs |

|

Capital Gain Worksheet 2015 Promotiontablecovers

| Title: Capital Gain Worksheet 2015 Promotiontablecovers |

| Format: eBook |

| Number of Pages: 165 pages Capital Loss Carryover Worksheet 2016 To 2017 |

| Publication Date: April 2019 |

| File Size: 810kb |

| Read Capital Gain Worksheet 2015 Promotiontablecovers |

|

Fillable Online 6 Short Term Capital Loss Carryover Fax Email Print Pdffiller

| Title: Fillable Online 6 Short Term Capital Loss Carryover Fax Email Print Pdffiller |

| Format: ePub Book |

| Number of Pages: 333 pages Capital Loss Carryover Worksheet 2016 To 2017 |

| Publication Date: March 2019 |

| File Size: 2.2mb |

| Read Fillable Online 6 Short Term Capital Loss Carryover Fax Email Print Pdffiller |

|

2016 Form 1040 Schedule D Edit Fill Sign Online Handypdf

| Title: 2016 Form 1040 Schedule D Edit Fill Sign Online Handypdf |

| Format: PDF |

| Number of Pages: 179 pages Capital Loss Carryover Worksheet 2016 To 2017 |

| Publication Date: September 2020 |

| File Size: 3mb |

| Read 2016 Form 1040 Schedule D Edit Fill Sign Online Handypdf |

|

Fillable Online Apps Irs Capital Loss Carryover Worksheet Irs Gov Fax Email Print Pdffiller

| Title: Fillable Online Apps Irs Capital Loss Carryover Worksheet Irs Gov Fax Email Print Pdffiller |

| Format: PDF |

| Number of Pages: 270 pages Capital Loss Carryover Worksheet 2016 To 2017 |

| Publication Date: January 2018 |

| File Size: 2.6mb |

| Read Fillable Online Apps Irs Capital Loss Carryover Worksheet Irs Gov Fax Email Print Pdffiller |

|

Tax Forms Irs Tax Forms Capital Gain

| Title: Tax Forms Irs Tax Forms Capital Gain |

| Format: PDF |

| Number of Pages: 139 pages Capital Loss Carryover Worksheet 2016 To 2017 |

| Publication Date: August 2018 |

| File Size: 6mb |

| Read Tax Forms Irs Tax Forms Capital Gain |

|

S Ftb Ca Gov Forms 2016 16 540nrd Pdf

| Title: S Ftb Ca Gov Forms 2016 16 540nrd Pdf |

| Format: PDF |

| Number of Pages: 335 pages Capital Loss Carryover Worksheet 2016 To 2017 |

| Publication Date: October 2017 |

| File Size: 1.7mb |

| Read S Ftb Ca Gov Forms 2016 16 540nrd Pdf |

|

2016 Sample Tax Forms J K Lasser S Your Ine Tax 2017 Book

| Title: 2016 Sample Tax Forms J K Lasser S Your Ine Tax 2017 Book |

| Format: eBook |

| Number of Pages: 270 pages Capital Loss Carryover Worksheet 2016 To 2017 |

| Publication Date: July 2017 |

| File Size: 1.5mb |

| Read 2016 Sample Tax Forms J K Lasser S Your Ine Tax 2017 Book |

|

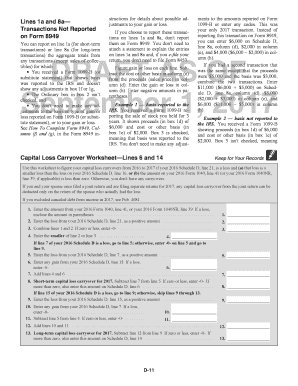

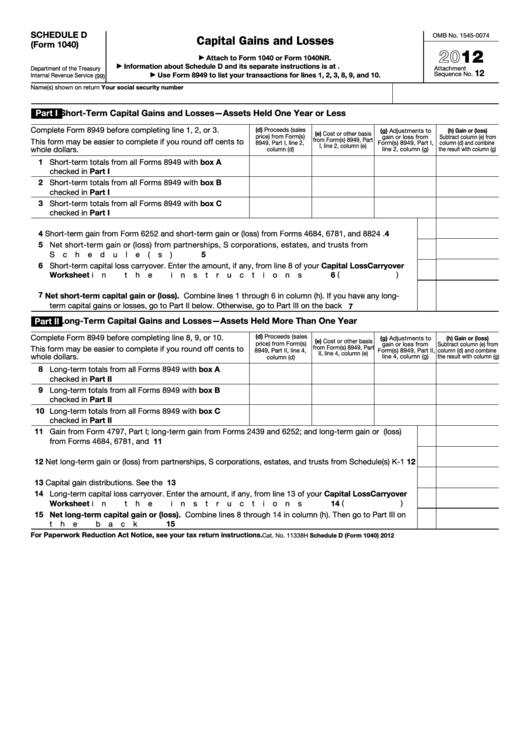

Fillable Schedule D Form 1040 Capital Gains And Losses 2012 Printable Pdf Download

| Title: Fillable Schedule D Form 1040 Capital Gains And Losses 2012 Printable Pdf Download |

| Format: ePub Book |

| Number of Pages: 289 pages Capital Loss Carryover Worksheet 2016 To 2017 |

| Publication Date: December 2017 |

| File Size: 1.8mb |

| Read Fillable Schedule D Form 1040 Capital Gains And Losses 2012 Printable Pdf Download |

|

Future Developments For the latest information about devel-opments related to Schedule D and its instructions such as legislation enacted after they were published go to IRSgov ScheduleD. You have a capital gain if you sell the good. School Buena Vista University.

Here is all you have to to know about capital loss carryover worksheet 2016 to 2017 Next you can use an additional 3000 loss to reduce 2017 income. Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2017 Schedule D line 16 or b the amount on your 2017 Form 1040 line 41 or your 2017 Form 1040NR line 39 if applicable is less than zero. If the net amount. Fillable online apps irs capital loss carryover worksheet irs gov fax email print pdffiller 2016 sample tax forms j k lasser s your ine tax 2017 book fillable schedule d form 1040 capital gains and losses 2012 printable pdf download tax forms irs tax forms capital gain capital gain worksheet 2015 promotiontablecovers 1040 operating loss faqs Right Wing Media Faceplant In Rush To Accuse The.

Tidak ada komentar:

Posting Komentar